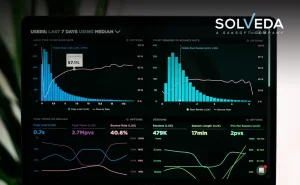

About Solveda

Headquartered in New York (USA) with offices in London, Gurgaon, Noida & Bangalore, we are an award-winning software design and development company. We have built large-scale cutting-edge eCommerce applications across the globe catering to B2B & B2C customers ranging from Fortune 500 companies to the world’s largest retailers.

Our Expertise

Leading Commerce Platforms

Curating value for our clients with our strong network of platform partnerships

Portfolio

What Clients Say About Us

Office Brands

It is an absolute pleasure to work with our e-commerce development partner, Solveda. Since working with them, our e-commerce platform systems have been stable and reliable. They are also helping Office Brands realize and achieve strategic business and technology goals. The Solveda team is accommodating, flexible, and agile in adapting to our business's rhythm, which is essential.

Winston Chan

IT Support ManagerCircuit City

Solveda, their OSLO Starter Store and HCL Commerce make the perfect combination to inexpensively build and deliver a new site. Alongside the ease and efficiency of the whole process, we have been really impressed at the lightning-fast performance of Headless Commerce. We would strongly recommend anyone considering high-end Commerce, speak to Solveda and choose HCL Commerce as their eCommerce platform

Ronny Shmoel

CEOSleepy's

We are already beating forecasted sales and doing better than projected online. We took significant sales through the website in the first 2 weeks and we have no doubt that our eCommerce initiative will contribute to a significant portion of our future revenue growth

Chris Cucuzza

VP of TechnologySteven Singer

Our ongoing partnership with Solveda will continue to improve our business short, medium, and long term.

Steven Singer

CEOGodrej & Boyce

Good team, who did lot of collaborative work with us to understand the work scope, problem statement and issue and did quality development.

Ashish Jain

eCommerce HeadBajaj Electricals

Its been 3 years that we have partnership with Solveda. Their outstanding ability and experience in the respective domain always helping us to solve your problem. Overall support before and after the development is really great!!!

Ashish Bhowmick

Digital Engagement & Development LeadAl-Yousifi

The service and deliverables they provided have lived up to our expectations. Their willingness to provide details and support are much appreciated.

Thomas Varghese

Head of ITCarrefour

Solveda is a niche and expert partner within the Commerce space, and their deep technical and business understanding was critical to the successful launch of our site. Their multi-continent exposure and past experience greatly reduced our time to market and project cost.

Subhodip Bandy

Director of ITBlogs

Contact us

Our team of experts would love to hear from you

Fill in the form or send us an email at

info@solveda.com

info@solveda.com